Updated September 29, 2021

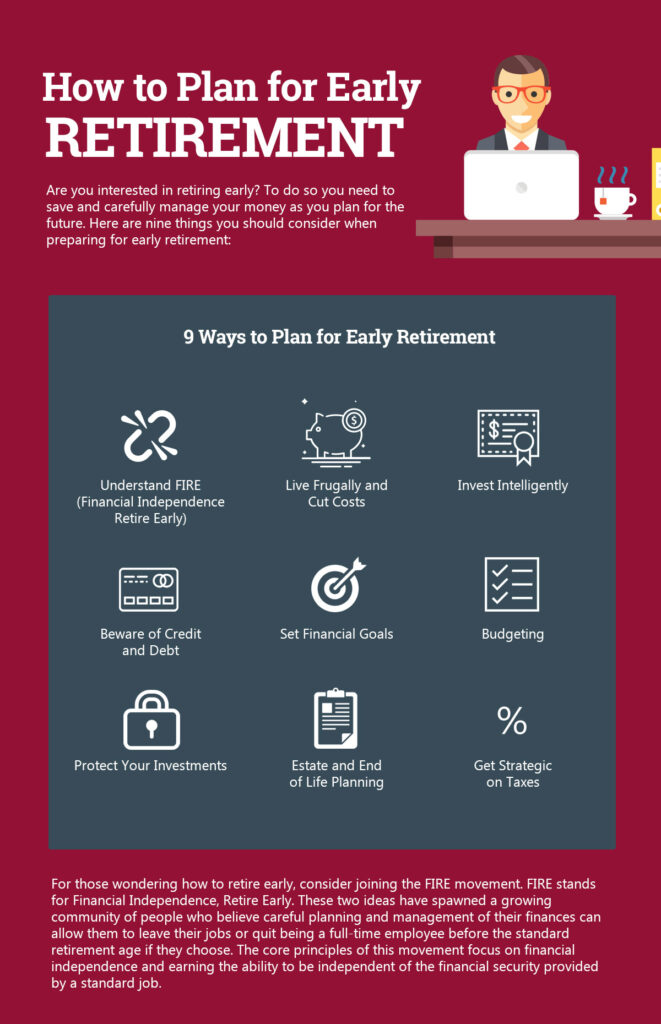

Are you interested in retiring early? To do so, you need to save and carefully manage your money as you plan for the future. Here are nine things you should consider when preparing for early retirement:

9 Ways to Plan for Early Retirement

- Understand FIRE (Financial Independence Retire Early)

- Live Frugally and Cut Costs

- Invest Intelligently

- Beware of Credit and Debt

- Set Financial Goals

- Budgeting

- Protect Your Investments

- Estate and End of Life Planning

- Get Strategic on Taxes

Some who aspire to retire early join the FIRE movement. Although this mindset is not realistic or practical for many, it works for some. FIRE stands for “financial independence, retire early.” These ideas have spawned a growing community of people who believe careful planning and management of their finances can allow them to leave their jobs or quit being a full-time employee before the standard retirement age if they choose. The core principles of this movement focus on financial independence and earning the ability to be independent of the financial security provided by a standard job. It’s important to keep in mind that this is not a feasible option for many W-2 income earners.

1. Understand FIRE (Financial Independence Retire Early)

The basics of FIRE include spending less than you make while saving at incredibly high rates. It also requires calculating the amount you must have saved in order to survive through your retirement. This amount depends entirely on your standard of living and associated costs for your family. It also takes into account how much you need to withdraw from your savings each year. Some estimates range from having saved hundreds of thousands to millions of dollars. Getting rid of mortgages, debt, and car payments as well as lowering your expenses allow you to potentially retire on a lower saved amount. In addition, investing savings into income producing assets is a smart move. Some FIRE advocates have retired as early as 30 with savings of around $1.2 million. Opponents of FIRE argue that these estimates are not enough to weather potential risks and recommend ranges higher than $10 million in savings.

It is important to note that financial independence is about not “needing” to work at an unfulfilling 9-5 job for the next 30-40 years. Instead, you can buckle down and jump your savings rate over 50%-75% of income and attempt to reach your financial goals in 10 years or less. The benefits include being able to walk away from that boring job and pursue work that inspires you regardless of how much you make. Many people who have obtained FIRE still work in some capacity, such as blogging, freelancing, starting a business, or pursuing their dream jobs. The idea is to focus on what makes you happy and fulfilled while you are younger and perhaps more physically able to enjoy those years.

There are many issues that can arise in the future and retiring early carries with it many risks. Running out of funds may require going back to work in later years when you may not be able to secure work as easily. Unexpected life events such as healthcare costs, theft, property damage, loss of assets, and market crashes are all possible scenarios that should be considered. There may be changes in circumstances such as a growing family, or worst case– the death of a partner that crushes your emotional state, not to mention income and savings. Some early retirees also face boredom and turn to side work to keep occupied. Consider these issues when designing your FIRE strategy and ensure your plan for financial independence doesn’t fall victim to the unexpected.

2. Live Frugally and Cut Costs

At the core of FIRE is the idea of spending significantly less than you make. Many advocates plan for a savings rate higher than 60% of income for 10+ years. Compare this to the typical saver who works until 66 years old, saving less than 10%-15%. Of course, getting a job with a higher income is one method. However, a common problem with those who earn more is the tendency to spend more as well. This is known as lifestyle creep, when we subconsciously start to reclassify a want or luxury as a need because we can now afford it. Instead of saving that money, it gets spent. There is no limit on who can benefit from FIRE principles, from those earning minimum wage to doctors and real estate moguls.

In tandem with saving more is the idea of cutting expenses and eliminating waste from your life. Most income goes toward housing and transportation costs, so discovering ways to reduce these costs will greatly impact your ability to save money. Many FIRE advocates are downsizing their homes in favor of smaller houses or even alternative living solutions. This may include moving across town or to a different state. It would be best to carefully consider all your options and perhaps consult with a professional before making a drastic change. Becoming mortgage-free allows for a potentially substantial increase in savings.

Besides housing, transportation is one of the next biggest costs. Instead of buying or leasing new vehicles, perhaps you could save by using an older, but still reliable, cost-efficient choice? Smaller, gas-efficient vehicles are also an option. Some people opt to carpool or take public transportation to cut costs. Others take it even further by ditching the car and either jumping on a bicycle or walking to work if the job is nearby. There may even be worthwhile health benefits to these options! Please be careful while walking or biking, especially in the early or late hours of the day when visibility is impacted. Dealing with the weather can also be an issue when commuting without a vehicle.

In addition to cutting housing and transportation costs, you could also consider lowering utility costs. Reducing usage and waste would lower monthly bills and provide significant savings over time. This includes costs associated with internet, cell phones, and television. There are always lower cost alternatives. In some cases, you may be able to eliminate these costs entirely. Instead of buying the latest and greatest technology, the money could be saved. You could use your local library, which usually offers a range of entertainment and internet access at little to no charge.

Downsizing and cutting costs wherever possible will free up more money to save for retirement. What you are willing to do will depend on what standard of living is acceptable to you– both before and after retirement– and how long you want to work until you get to that point. Try to meet your needs with less expensive options that are still viable. In many cases, early retirees manage costs by taking on tasks that might usually be outsourced. Instead of buying a replacement when something breaks, you could learn how to fix it yourself. There are plenty of how-to guides available online for just about everything. You can learn to make, build, and repair almost anything these days. Of course, it is important to approach this carefully, which means doing your due diligence. Some tasks may be too big or dangerous to attempt on your own. In these cases, there are still lower cost alternatives to consider.

3. Invest Intelligently

It is vital to invest your money intelligently, so you can reap the full reward of your work. Consider diversifying, so any sudden changes in the market will not wipe out all your savings. When you retire, your financial needs will change over time. When you reach 60, you can expect to start withdrawing from pensions and social security without facing heavy penalties. However, this alone may not be enough to live on at that time. For those planning to retire before 60, you must consider a retirement plan to reach that age and beyond.

The accessibility of your assets is also an issue. Some funds will be more easily liquidated than others. Be sure to consider a plan that allows for the liquidation of certain assets at the best times to do so. Investing your money into real estate or other income-producing assets will help manage withdrawals. While you are still working, invest in an employer-sponsored 401(k) or similar program, especially if the employer offers a matching program. This allows you to place pre-tax funds that are matched into retirement accounts. These retirement savings will grow until you reach the normal retirement age (unless you take an early withdrawal).

Talk to a financial advisor about other tax-free investments, as well. Many proponents of early retirement prefer the benefits of low-cost index funds. These funds include a broad range of investments which diversify for you and generally seem to perform better than some individual traders. There are also a wide variety of low-cost index funds from providers such as Vanguard, Charles Schwab, and BlackRock. Be sure to look at other costs that may be tacked onto the investment, such as transaction and management fees.

Due to competition, many of these funds offer very competitive rates based on basis points. 10 basis points is 0.1% of your investment. There are also zero-fee investment funds being offered today from companies such as the Fidelity ZERO Total Market Index Fund (FZROX). There may be trading costs involved with these investments, so as with everything involving your finances, take care to understand all of the factors involved. Consult with a professional to ensure you are engaging in the best possible investments for your goals.

4. Beware of Credit and Debt

Credit cards and debt management is another key topic in the FIRE movement. Credit is useful for a wide range of activities, and managing that credit is an important task. However, financial independence involves ditching the debt and repurposing those funds towards savings. This includes vehicle and home loans. Limiting these purchases is considered beneficial but be aware that credit is still a valuable tool. Many people saving for retirement make excellent use of credit to take advantage of the deals offered by various companies. Consider earning miles when you open an account or pay for travel with an airlines credit card. As long as you pay them off immediately, you can maintain no credit balances but reap the rewards of these programs. Thus, you avoid the high-interest rates and get a deal to boot. Some early retirees use this method to get free travel and other perks. Be sure to carefully consider the fine print in these plans so you don’t get sidelined with unexpected fees and charges.

Another issue facing FIRE planners is the problem of debt, especially when it comes to education. Student loans can place financial obligations on a person for many years. FIRE proponents point out that there are plenty of cost-saving strategies for earning a degree, such as attending community college for an associate degree then transferring to a university. There are also many affordable education options today, such as online and remote classes. Some employers even offer great education plans or free job training. You could also consider investing in an education savings plan for you and your family. These plans even offer tax advantages on qualified spending.

5. Set Financial Goals

As discussed above, a higher savings rate is needed in order to obtain the ability to retire early. Jumping your savings rate from 10-15% to over 60% may seem like an impossible task when living paycheck to paycheck. First, consider setting financial goals by determining what dollar amount you actually need to save in order to retire. This depends on your retirement goals: What standard of living do you want to have when you retire? How long do you want those funds to last? Many thrifty retirement planners claim that a 4% annual withdrawal rate is an average safe estimate needed to live comfortably. 4% of $1.2 million would be an annual rate of $48,000. However, this doesn’t take into account federal and state taxes, inflation, and the rate of return your investments are earning. Some argue that 2%-3% would be safer and some argue that more would be needed.

Focus on a lifestyle that will make you the happiest in order to estimate expected costs after retiring early. Follow FIRE strategies for cutting costs– eliminating your mortgage and vehicle expenses may leave you requiring much less than you might expect each year. However, it is important to consider that unexpected costs may arise down the road along with higher prices due to inflation or possible market crashes and loss of investments.

6. Budgeting

Once you have your financial goals determined, it’s time to set the budget for your financially independent retirement plan. This is where you can manage your day-to-day spending and weekly or monthly costs. There are a wide variety of tools available to help manage these tasks, ranging from ledgers to apps and automatic saving programs. You might consider setting up a separate savings account and automatically withdrawing the money from each paycheck for auto-investment options. Having that money moved before you’re tempted to spend it on luxuries can help you save.

Food costs are another major area where money is lost each month. Many Americans prefer eating out at tasty restaurants or grabbing fast food, but this burns up valuable potential savings. Instead, consider more efficient food budgeting and meal preparation. Buying in bulk from the supermarket and cutting costs wherever possible will allow more to be invested for the future. Cooking at home is much more cost effective than a quick meal at a restaurant. If time is a concern, you could prepare several meals at once to freeze and spread throughout the week. When you consider how much you spend on food each month, the answer may shock you.

7. Protect Your Investments

Despite our best plans and intentions, things can– and do– go wrong. Disaster can strike at any time. Critics of FIRE argue that retiring early not only lowers earning and saving potential for later in life but leaves the early retiree unprotected in emergency situations. You could suddenly find yourself in dire straits with no access to regular income from a job. Health problems or accidents could leave you unable to work. There are many possible scenarios that could impact your long-term financial strategy.

To ensure that you and your family are protected, it’s wise to diversify your early retirement portfolio. It is also important to consider some basic insurance provisions for life, healthcare, vehicle, property, and more. Unfortunately, many predict that healthcare costs will continue to rise. Not only are drug and hospital costs rising, but insurance companies are passing more of the costs onto policyholders to encourage healthier living and more responsibility for health care. Health insurance is a key consideration of any retirement plan. Early retirement benefits are usually not available through Medicare unless you have a disability.

Modern healthcare is allowing people to live better for longer. It makes sense to consider a variety of insurance options to protect your investments– including your health. There are many ways to protect yourself and your family including tax beneficial savings accounts.

8. Estate and End-of-Life Planning

No long-term plan is complete without considering what to do with your estate at the end of your life. While some may view this as an unpleasant topic, it is a vital one to consider. What do you want to do with your assets? What if an accident happens? Do you have arrangements in place to care for your family immediately?

Currently, the recent Tax Cuts and Jobs Act greatly raises the estate tax exemption for the next few years. It may be worth your time to consult with a tax advisor about how best to arrange your estate and pass assets on to your loved ones. It may even be beneficial to set up living trusts to protect your assets from probate and other issues. Trusts have a variety of uses including purchasing real-estate.

9. Get Strategic on Taxes

Taxes are another important consideration when planning for early retirement. You will still owe taxes, including property tax, after you retire. This is another excellent reason to consider moving to a smaller house or apartment in order to manage costs. Create a tax strategy which includes tax-free investment options. Tax-deferred savings have greater compounding potential than after-tax investments, but they also carry penalties if withdrawn early.

Carefully managing taxes is vitally important because early retirement accounts accrue less than those who work until the standard retirement age. These lost additional investments are one of the main arguments against retiring early. Managing investments can allow some to live tax-free in retirement. By carefully withdrawing from different investment accounts at the right amounts and the right times, you can greatly minimize your tax liability. Some accounts allow for tax-free withdrawals at the federal and state levels on eligible purchases. To set up the best tax plan for your retirement reach out to an Anderson Advisor tax professional today.

Early Retirement Legalities to Consider

Financial independence doesn’t mean that you can easily access all of your investments whenever you want. Full retirement is currently set at age 66, but federal government early retirement amounts can be withdrawn as early as 62 at reduced rates. Medicare eligibility usually starts at 65 unless you are disabled. You can start an application for early retirement three months before turning 62. In some cases, such as having performed military service, you could take early retirement at 55 without facing penalties. Not everyone can apply for early retirement social security benefits. If you’re not at Social Security early retirement age, you must ensure that you have enough saved to not only reach these standard retirement ages but also to supplement these benefits for many years to come.

Generally, we must also wait until turning 59 1/2 before withdrawing from individual retirement accounts (IRAs) and 401(k) retirement accounts. 401k early retirement withdrawals before this age can carry penalties on top of taxes unless certain conditions apply. Exceptions include some medical or college expenses, as well as up to $10,000 used for a first home purchase. Inherited IRAs may also allow penalty-free withdrawals in some cases. It is even possible to use a retirement account to fund a business start-up in some situations. These and other options exist but take careful consideration and seek professional advice to avoid these penalties.

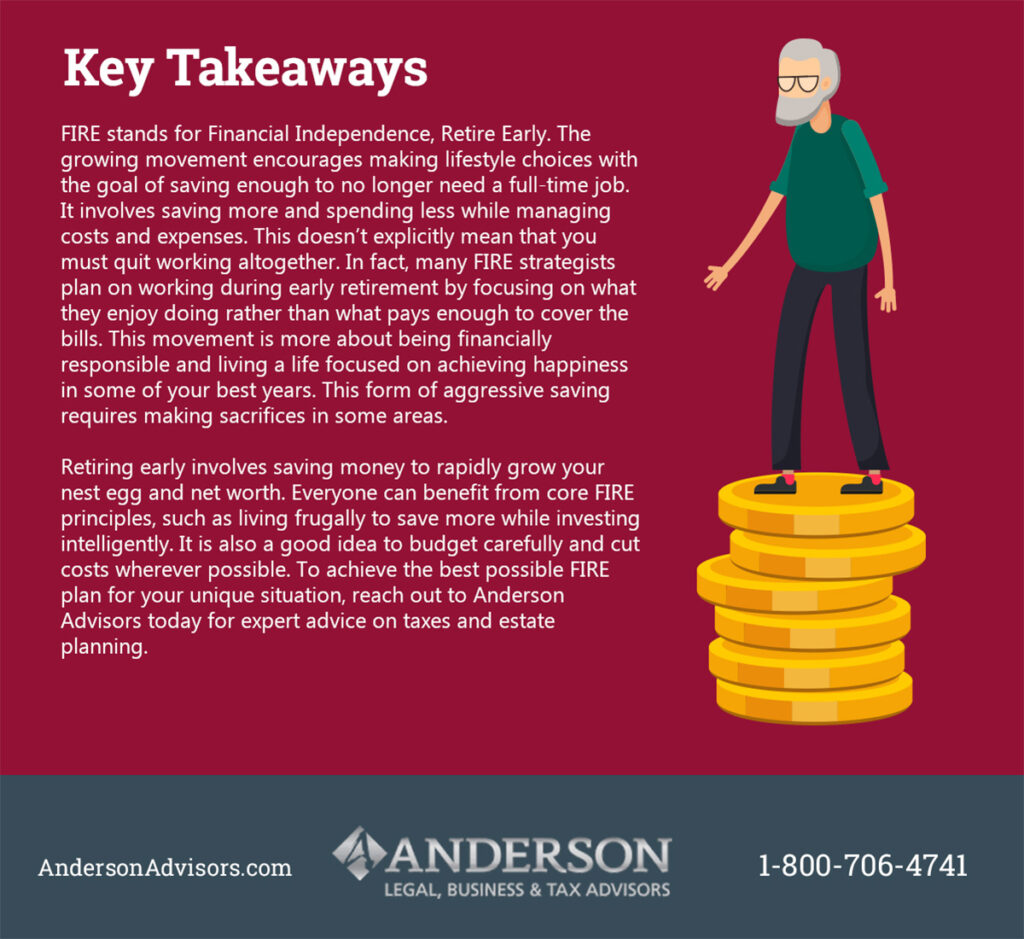

Key Takeaways

FIRE stands for Financial Independence, Retire Early. The growing movement encourages making lifestyle choices with the goal of saving enough to no longer need a full-time job. It involves saving more and spending less while managing costs and expenses. This doesn’t explicitly mean that you must quit working altogether. In fact, many FIRE strategists plan on working during early retirement by focusing on what they enjoy doing rather than what pays enough to cover the bills. This movement is more about being financially responsible and living a life focused on achieving happiness in some of your best years. This form of aggressive saving requires making sacrifices in some areas.

Retiring early involves saving money to rapidly grow your nest egg and net worth. Everyone can benefit from core FIRE principles, such as living frugally to save more while investing intelligently. It is also a good idea to budget carefully and cut costs wherever possible. To achieve the best possible FIRE plan for your unique situation, reach out to Anderson Advisors today for expert advice on taxes and estate planning.

Share this Image On Your Site

Free Strategy Session with an Anderson Advisor

Receive a detailed risk assessment to assist in lowering problem areas that could wipe out all of your assets with one wrong move. Speak with an Anderson Professional Advisor to get your FREE Strategy Session.

Limited-Time Offer: ($750 value.)