Key Takeaways:

- The decline in Airbnb’s revenue per active listing in some cities does not indicate a housing market crash.

- The total number of short-term rentals in the United States accounts for less than 1% of all homes, making it unlikely to significantly impact the housing market.

- Despite a decline in revenue per active listing in some cities, the overall revenue of Airbnb has increased over the last three years.

The Airbnb “Collapse” – A Closer Look

Despite the claims of a significant decrease in Airbnb’s revenue per active listing, the overall revenue of Airbnb has actually increased by 70% over the last three years. This suggests that the short-term rental market is not collapsing, but rather adjusting to supply and demand dynamics.

For instance, in Phoenix, the number of short-term rentals has increased from 5,000 in 2017 to 21,000 now. This increase in supply has led to a decrease in revenue per active listing, but it doesn’t mean that the demand is collapsing or that people will have to sell their properties. It’s crucial to understand that these changes are part of a normal market adjustment and not indicative of a broader market collapse.

The Impact on the Housing Market

The housing market is influenced by a variety of factors, and the number of active Airbnb listings is just one of them. Currently, the United States has some of the lowest numbers of active listings in the last ten years, with about 600,000 units. To significantly impact the housing market, there would need to be millions of new listings.

Even if every single short-term rental property was listed for sale, it would only account for about 1.2 million properties. This would be absorbed quickly by the market and would not cause a housing crash. This is because the housing market is a complex system influenced by a multitude of factors, including interest rates, economic conditions, and consumer confidence, among others.

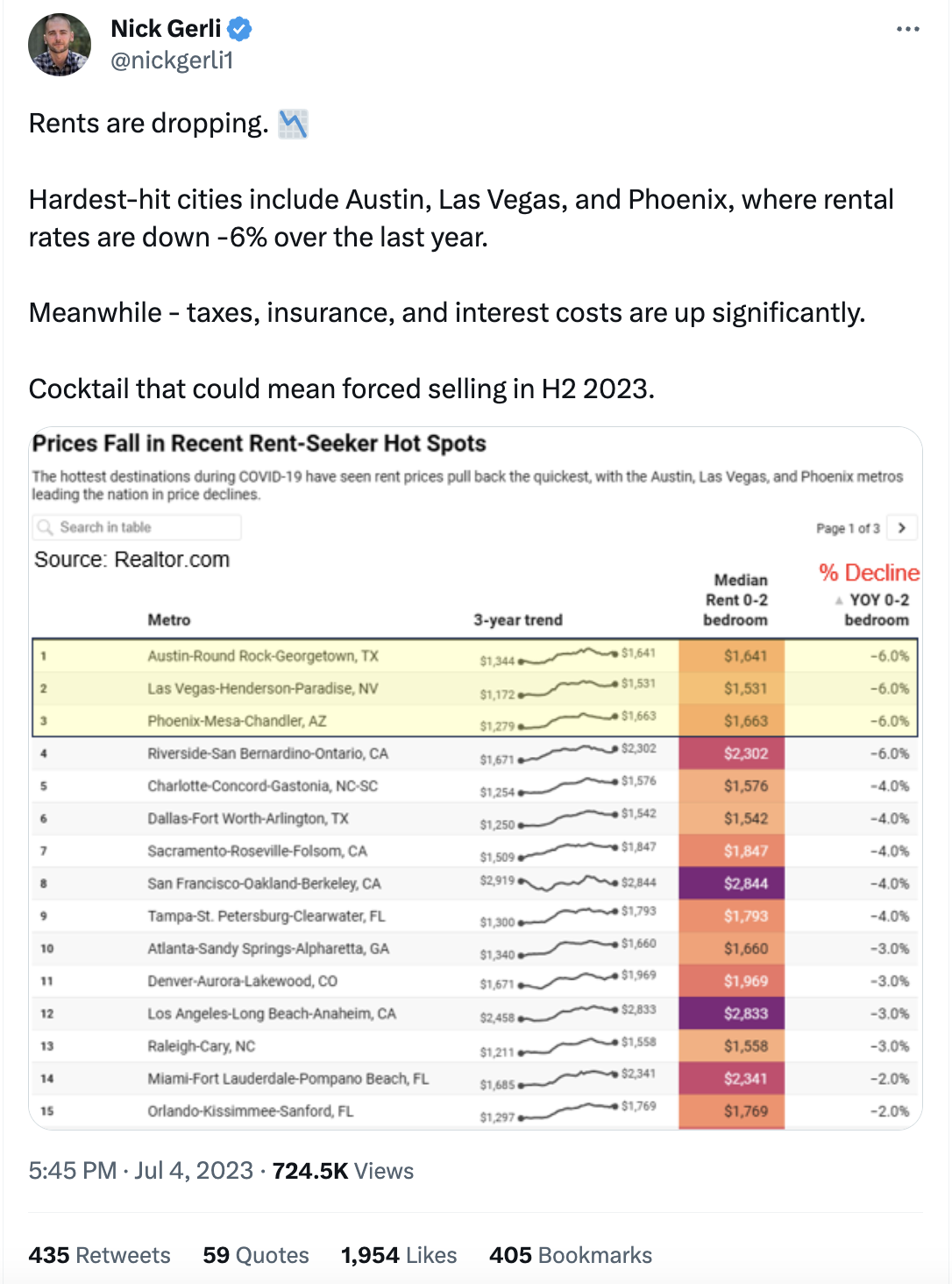

The Real Estate Market in 2023

As of mid-2023, we are on pace for 130,000 foreclosures this year, a far cry from the 2.9 million in 2010. The increase in interest rates has led to low supply, which could result in pent-up demand. However, this does not equate to a housing crash. Even with a decline in Airbnb’s revenue per active listing, the rental income from these properties still surpasses that of traditional rentals.

The current real estate market conditions are a result of various factors, including economic conditions, changes in interest rates, and shifts in consumer behavior. While the performance of Airbnb and other short-term rental platforms can influence the market, they are not the sole determinants of the market’s health.

In Conclusion

The decline in Airbnb’s revenue per active listing in some cities is not indicative of a housing market crash. It’s a reflection of market dynamics, specifically supply and demand. Even if all short-term rental properties were listed for sale, it would not significantly impact the housing market due to the low percentage they represent of total housing inventory.

The housing market is influenced by a variety of factors, and while Airbnb is a part of the equation, it’s not the sole determinant of the market’s health. Understanding these dynamics can help us make informed decisions and predictions about the future of the housing market. It’s essential to look beyond the headlines and delve into the data to get a comprehensive understanding of the situation.

Free Strategy Session with an Anderson Advisor

Receive a detailed risk assessment to assist in lowering problem areas that could wipe out all of your assets with one wrong move. Speak with an Anderson Professional Advisor to get your FREE Strategy Session. Limited-Time Offer: FREE (a $750 value.)