The Real Picture: Facts and Figures

The data shared with you in this blog comes from reputable sources such as the Joint Center of Housing Studies, Black Knight, the Federal Reserve, and CoreLogic. These organizations have their fingers on the pulse of the real estate market, and their insights are invaluable.

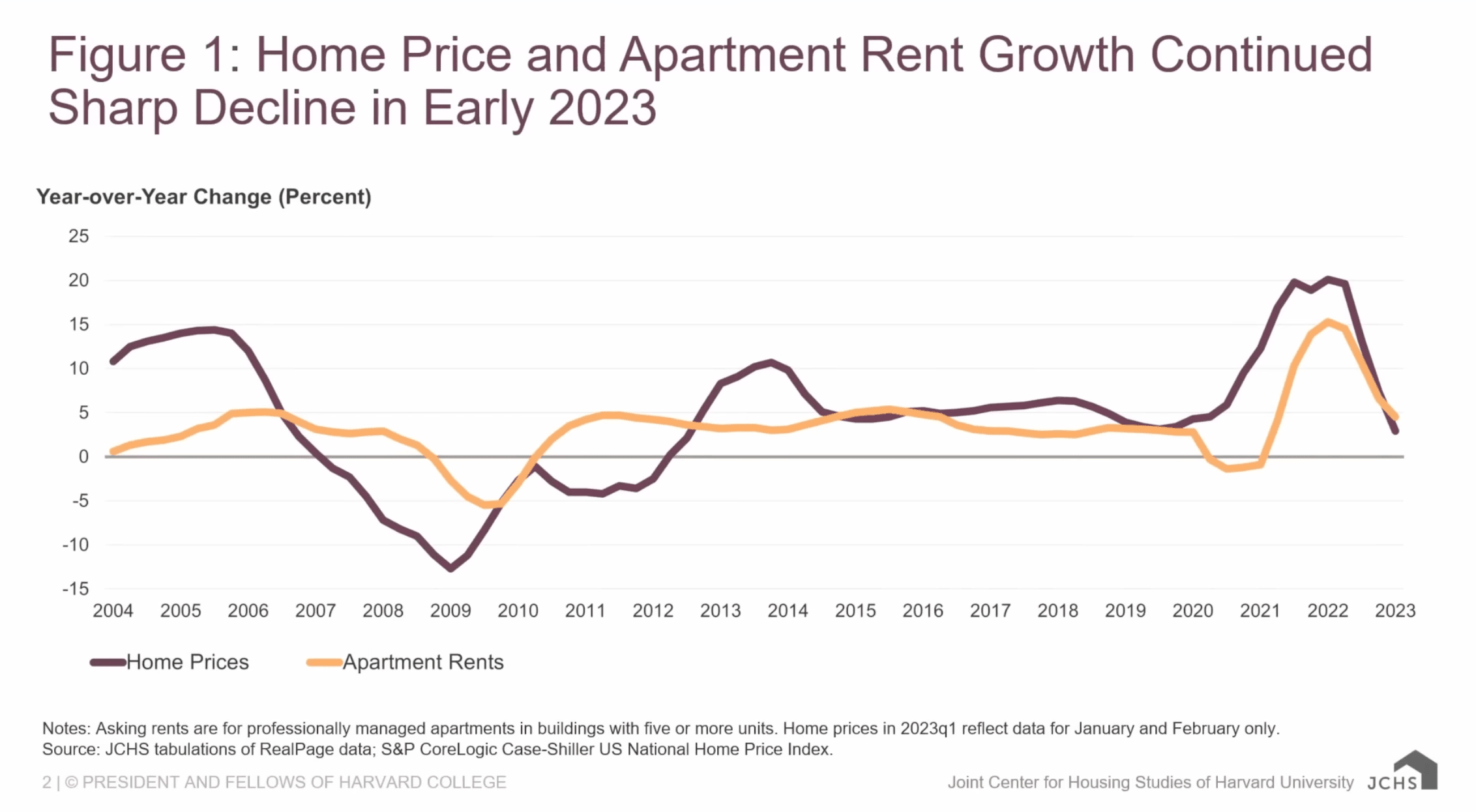

Now, you might have heard that the growth rate of home prices and apartment rents is declining sharply. But let’s be clear about what that means. The growth rate is slowing, not declining. In other words, home prices are still increasing, just not as rapidly as before. It’s like your dollar growing by 20% one year and then by 10% the next. You’re still making money, just not as much. So, let’s not confuse a slowdown with a crash.

The Impact of Rising Interest Rates

Interest rates have been on the rise, and this has undeniably made payments on median-priced homes more expensive. But what does this mean for the housing market as a whole? Well, it’s not all doom and gloom.

Rising interest rates have indeed put a damper on the construction of single-family homes. However, this doesn’t mean the market is about to crash. It’s more like an airplane adjusting its altitude – it’s not falling out of the sky, just descending a bit. And remember, the Federal Reserve is still adjusting interest rates, so we can expect some fluctuations in the future.

The Supply and Demand Dynamics

Let’s talk about supply and demand, the two fundamental forces that drive any market. The supply of homes is low, and this is keeping home prices near record highs. But what about foreclosures? Aren’t they supposed to flood the market with cheap homes and cause prices to plummet?

Well, not exactly. While it’s true that foreclosures can increase the supply of homes, the current rate of foreclosures is actually quite low. And it’s dropping. This means that we’re not likely to see a sudden surge of cheap homes flooding the market anytime soon.

And let’s not forget about home equity. The average amount of home equity right before the recent adjustments was over $200,000. That’s a significant buffer that can protect homeowners from a potential crash.

The Role of Investment Hedge Funds

It’s worth noting that investment hedge funds, such as BlackRock, are playing a significant role in the current housing market. They’re snapping up properties in many cities, viewing them as excellent investment opportunities. While some may argue that this is driving up prices and keeping people out of the market, it’s essential to remember that these groups are also contributing to the demand side of the equation. They’re not the villains of the housing market story, but rather another set of players responding to the same supply and demand dynamics we all face.

The Impact of Inflation on Building Materials

One factor that’s been making headlines recently is the skyrocketing cost of building materials. Inflation is rearing its ugly head in this sector, driving up the cost of everything from lumber to concrete. This is making it more expensive for builders to construct new homes, which in turn contributes to the supply shortage we’re currently experiencing. However, it’s important to remember that inflation is a complex issue with many contributing factors, and it’s not solely responsible for the current state of the housing market.

The Opportunity in Affordable Housing

Despite the challenges, there are still opportunities to be found in the housing market. One area that’s ripe for innovation is affordable housing. With the current housing crisis in the United States, affordable homes are needed more than ever. This presents a golden opportunity for investors who are willing to think outside the box and find creative solutions to this pressing issue. Remember, the reward is usually in proportion to the problem you’re solving. So, if you can find a way to provide affordable housing in today’s market, you stand to be rewarded handsomely.

Conclusion

So, is the housing market about to burst? The data suggests otherwise. Yes, the growth rate is slowing, and interest rates are rising. But these are adjustments, not signs of an impending crash. The supply of homes is low, foreclosures are dropping, and home equity is high.

As investors, it’s crucial that we base our decisions on facts, not fear. The housing market is complex and ever-changing, and it’s our job to stay informed and adaptable. So, let’s keep our eyes on the data, our minds open, and our investment strategies flexible.

Remember, the housing market isn’t just about numbers and charts. It’s about homes, communities, and people. And as long as people need places to live, there will be opportunities for us as investors.

Free Strategy Session with an Anderson Advisor

Receive a detailed risk assessment to assist in lowering problem areas that could wipe out all of your assets with one wrong move. Speak with an Anderson Professional Advisor to get your FREE Strategy Session.

Limited-Time Offer: ($750 value.)