Hotels

FAQ

LOCATION

Anderson Event Center

Address: 1980 Festival Plaza Drive, Suite 550

Las Vegas, Nevada, 89135

Phone: +1 (888) 629-8876

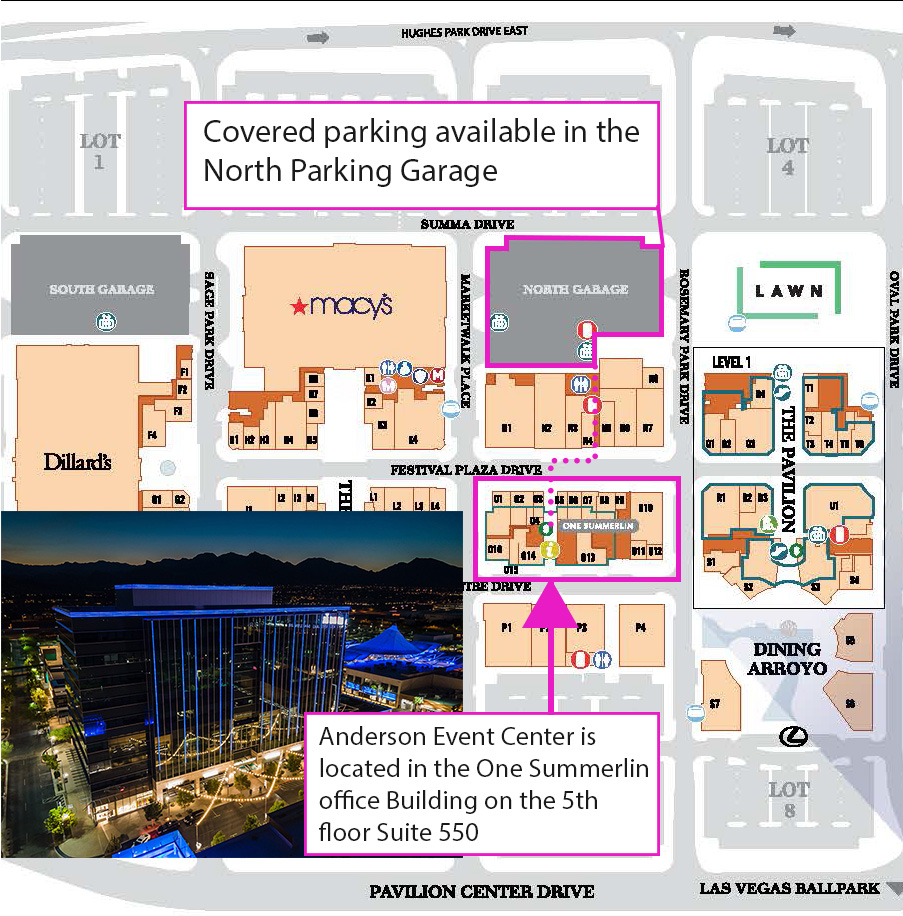

Parking

Event Parking Map

- North Parking Garage is ideal, offering a covered corridor to our office behind the Apple Store.

- The Anderson Event Center is located in the One Summerlin office building on floor 5 Suite 550.

Hotel Recommendations for Anderson Business Advisors Seminars

Red Rock Casino Resort & Spa

11011 W Charleston Blvd, Las Vegas, NV 89135

Phone: 702-797-7777

Distance from Anderson Event Center: Less than 1 miles

Website: Here

Element by Westin

10555 Discovery Drive, Las Vegas, NV 89135

Phone: 702-589-2000

Distance from Anderson Event Center: 3 miles

Website: Here

JW Marriott Las Vegas Resort and Spa

221 N Rampart Blvd Las Vegas, NV 89145

Phone: 702-869-7777

Distance from Anderson Event Center: 4 miles

Website: Here

Suncoast Hotel and Casino

9090 Alta Drive Las Vegas, NV 89145

Phone: 702-636-7111

Distance from Anderson Event Center: 4 miles

Website: Here

La Quinta Inn and Suites

9570 W. Sahara Ave, Las Vegas, NV 89117

Phone: 702-243-0356

Distance from Anderson Event Center: 3 miles

Website: Here

Durango Casino & Resort

6915 S Durango Dr, Las Vegas, NV 89148

Phone: (888) 899-7770

Distance from Anderson Event Center: 8 miles

Website: Here

Featured Speakers

Gwendy Wolfe

Senior Attorney

Gwendy Wolfe is a Senior Attorney with nearly a decade of experience in nonprofit law, asset protection, and operating agreements. An alumna of J. Reuben Clark Law School, she combines her background in litigation and advisory roles to offer expert counsel at Anderson Business Advisors, where she integrates asset protection with tax planning. Passionate about advocacy, Gwendy ensures her clients’ interests are safeguarded. Outside of work, she enjoys reading and spending time with her family.

Preston Knight

Senior Attorney

Preston Knight, a Senior Attorney at Anderson Advisors, transitioned from a 6-year career as an Air Traffic Controller in the US Air Force to law after being inspired by friends who became lawyers. He earned his Juris Doctorate from the University of Utah and leverages his experience as a small business owner, currency investor, and real estate investor to assist clients with tax and asset protection. Outside of work, Preston enjoys spending time with his family.

Jeff Cottle

Senior Attorney

Jeff is one of our Senior Attorneys at Anderson Business Advisors. He is a transactional attorney who specializes in strategic planning for real estate investors and business owners with a focus on asset protection and tax planning. He has unique experience and interest in the areas of healthcare and all things contracts. Jeff has an analytical mind and an accessible personality, allowing him to develop rapport with clients while helping them to understand complex legal principles. He enjoys using the practical side of the law to prevent potential problems before it’s too late.

Carter Coons

Attorney

Carter Coons brings a wealth of experience and expertise to his role, particularly in entity formation, asset protection, and taxation. His passion lies in helping clients navigate the complexities of the legal system, shielding them from frivolous lawsuits and other potential pitfalls. Before joining Anderson, Carter honed his skills as a tax attorney at Deloitte. Additionally, his upbringing in a family deeply entrenched in the real estate industry—spanning three generations—has provided him with invaluable insights into investment strategies and real estate matters.

Troy Butler

Tax Supervisor

Troy is the Bookkeeping Manager at Anderson Business Advisors. In addition to bookkeeping, he has over ten years of experience in corporate and personal tax planning, strategizing, and preparation. Troy’s extensive knowledge of bookkeeping and tax preparation allow him educate others on the importance of both and how they work together.

Amanda Wynalda

Executive Attorney

Amanda is an attorney licensed in California. Prior to Anderson, she worked in tax, estate planning, family law, and sports/entertainment. As a student at Pepperdine Law, she worked at the IRS Chief Counsel’s office in the Small Business/Self-Employed and Tax Exempt and Government Entities divisions. She regularly presents at our Structure Implementation Series covering tax preparation and planning strategies.

Jonathon Evans

Supervising Attorney

Jonathon Evans decided early on to become a lawyer in a field where he could make a difference. Drawn to estate and business law by mentors who seemed both fulfilled and full of compelling stories, he earned his Juris Doctor from J. Reuben Clark Law School at Brigham Young University. Joining Anderson Advisors in 2020, Jonathon specializes in estate planning and asset protection, blending his legal expertise with personal experience as a stock market and real estate investor. As the Supervising Attorney, he finds great satisfaction in leading and empowering Anderson’s Platinum Attorneys as they offer exceptional, personalized services to help clients safeguard their investments and build lasting legacies.

Agenda

DAY 1 – Thursday, October 24 (9am – 5pm PT)

Finishing Touches on Your Business Entities: You own a company now! Now what?

- Overview of completed filings (state, federal)

- Action items for owners: responsibilities in managing their structure

- Finalizing entities: roles, anonymity, and governing documents

- Key tasks: signing documents, BOI report, ongoing maintenance

- Emphasis on CAP program for continued support

Finishing Touches on Your Trusts

- Overview of various types of trusts (Land Trusts, PRTs, etc.)

- Finalizing trusts: roles, trust agreements, and beneficial interest

- Connecting trusts to living trust for legacy preservation

- Stress the importance of maintaining control over your legacy

Putting Your Structure to Work: Bank Accounts, Funding, and Cashflow

- Review of business structures (LTRs/STRs, LLCs, Trusts)

- Bank account setup and management tips

- Strategies for flipping, wholesaling, and trading

Keep Your Structure Running

- Importance of governing documents and renewals

- Meetings, minutes, records, and annual compliance

- Tax deadlines and filings

- Overview of the Platinum Portal for Anderson’s assistance

DAY 2 – Friday, October 25 (9am – 1pm PT)

Great Books Make Great Tax Returns: Bookkeeping for Business Entities

- Importance of proper bookkeeping for successful tax returns

- Introduction to the Bookkeeping Essentials package

Putting Money Back in Your Pocket: Tax Strategies

- Breakdown of different types of income and tax treatments

- Key tax strategies: Accountable plan, 105b, 280A, REPS, STR Loophole

- Administrative office and other tax-saving methods for business structures

*Topics and schedules may be adjusted.

Event Overview & FAQ

Venue/Accommodations

What are the dates of the event?

Thursday, October 24, 9am – 5pm PT & October 25, 9am – 1pm PT

What airport do I fly into?

Tickets & Registration

Who can attend?

This is an exclusive event for Anderson clients. You are welcome to bring a guest, provided they are also an Anderson Business Advisors client.

What is the cancellation policy?

If you are unable to attend, please contact us promptly at 888-629-8876 so we can offer your spot to other clients.

Can I attend the event virtually?

General Event Questions

Event Center parking?

Free parking