BENEFITS OVER A SELF-DIRECTED IRA

Full Investment Control

No custodian involvement

No custodian fees

Borrowing From Your Plan

Leverage Funds for Real Estate Transactions

Diversity in Investment Options.

Superior Tax Planning Opportunities

Unsurpassed Asset Protection

Full Investment Control

No custodian fees

Leverage Funds for Real Estate Transactions

Superior Tax Planning Opportunities

No custodian involvement

Borrowing From Your Plan

Diversity in Investment Options.

Unsurpassed Asset Protection

Full Investment Control

No custodian involvement

No custodian fees

Borrowing From Your Plan

Leverage Funds for Real Estate Transactions

Diversity in Investment Options.

Superior Tax Planning Opportunities

Unsurpassed Asset Protection

Full Investment Control

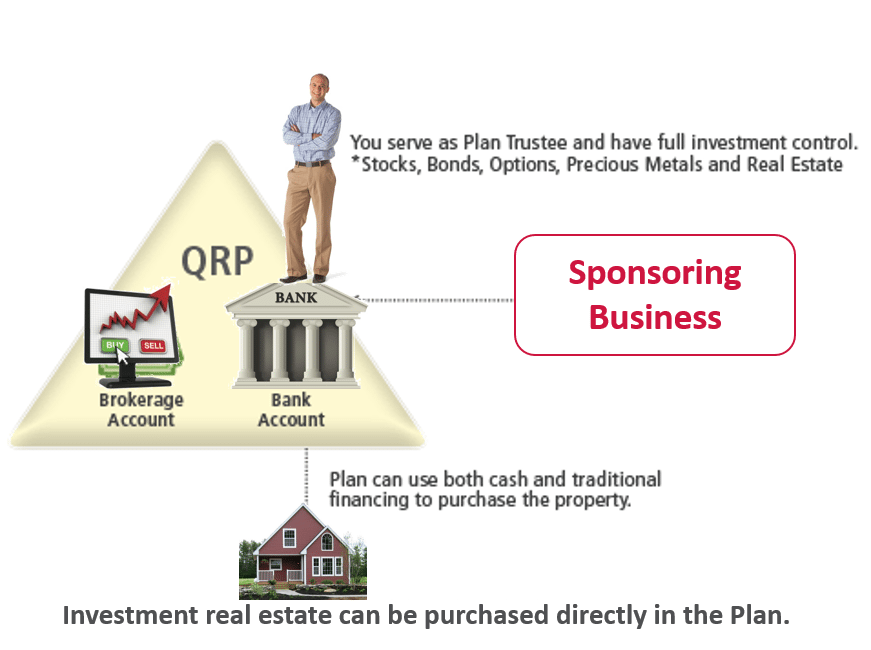

You can serve as the plan trustee of the QRP. As plan trustee, you will have full control to invest your retirement account as you see fit. Unlike an IRA, you do not have to run your investment transaction through a custodian and hope the custodian gets back to you in a timely fashion. There are few limitations on the types of investments that can be made. Our clients utilize their QRPs for investing in stocks, bonds, options, futures, and currency; as well as real estate transactions such as rentals, tax liens, tax deeds, and hard money lending. Unlike IRAs, the QRP is governed by different tax laws and has the ability to acquire real estate using traditional mortgages without the 35% adverse tax consequence of UDFI.

Since you can create your QRP at any bank or brokerage firm, you greatly lower the cost of administration since you avoid IRA custodian fees.

TAX PLANNING

Tax Deductible Contributions:

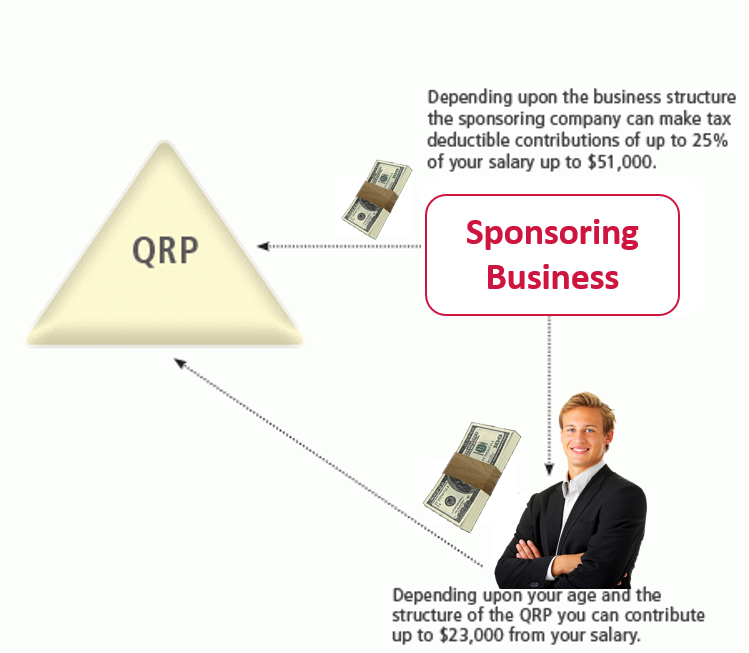

With a QRP you have the ability to create tax-deductible contributions for both you and your business. The tax-deductible contributions to your QRP will grow tax-deferred allowing you to take full advantage of compounding returns. Once you elect to take plan distributions you will pay tax at your then current tax bracket on the funds. You have the ability to begin penalty-free distributions between the ages of 55 and 70.5. Once you reach 70.5 you must take the required minimum distributions from the plan.

The power of tax-deferred growth: If you invested $10,000.00 per year for 30 years in a tax-deferred vehicle at an interest rate of 15%, you would end up with $5,000,000.00 after 30 years compared to $1,500,000.00 if the investment was subject to taxes. This is a net increase in the retirement account value of $3,500,000.00.

After-Tax Contributions with Tax-Free Growth:

If you adopt a QRP that allows Roth contributions, you do not receive an upfront tax deduction but the funds will be distributed to you as tax-free income.

The QRP allows you to make both tax-deductible and after-tax contributions. The after-tax contributions are made by you as an employee. These after-tax contributions are currently almost 3 times what you can contribute to a Roth IRA on an annual basis. If your business needs additional tax deductions it can make tax-deductible contributions on your behalf to a tax-deferred account. The benefit of this planning opportunity is that you can create both tax-free and tax-deferred retirement wealth.

The key feature of the QRP is that you and your business have full discretion on the contributions depending on income availability for a given year.

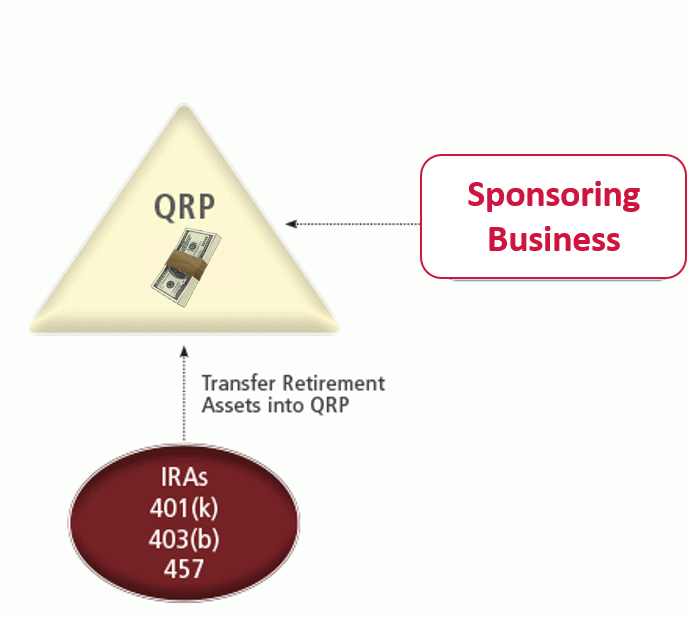

Consolidation of Retirement Plan Assets Accounts

You may roll over funds from an existing qualified plan or a deductible IRA into your QRP. This gives you the ability to access all of your retirement funds from one individual or pooled account. If you are married, you and your spouse can pool your funds in one account to permit even greater investing.

Borrowing From Your Plan

Need some extra money? Unlike an IRA, you can borrow from your QRP without penalties or taxes. As a participant you are able to borrow up to 50% of your vested plan balance with a maximum cap of $50,000. This loan is treated as a plan investment and you pay the loan interest back to your plan instead of a bank or credit card company, thus enabling your plan to make money on your loan. Unless the loan is for the purchase of a primary residence you pay your loan back quarterly for up to 5 years.