Should I Have a Land Trust?

A Land Trust is a must-have asset protection tool for any real estate investor.

Why Form Your Land Trust With Anderson?

Would you like a perfect stranger, with minimal knowledge and a computer, to have access to your financial information? Of course not, that is why land trusts are an invaluable tool in any savvy investor’s toolbox. A land trust can provide privacy and lender protection for real estate investors and, when used in conjunction with an LLC, can provide immeasurable asset protection.

Besides their asset protection and privacy benefits, land trusts also help real estate investors avoid the threat of violating the “due-on-sale” clause in their mortgages. This clause, included within most mortgages, gives lenders the option to demand full payment of a loan balance when the financed property ownership transfers without the lender’s prior consent.

With a land trust in place, used in conjunction with an LLC, you have the freedom to transfer ownership into your LLC without triggering the mortgage’s “due-on-sale” clause. Also, like a living trust, there are legal protections built in to prevent lenders from enforcing the “due-on-sale” clause. (Garn St. Germain Act.)

What are other benefits of a Land Trust?

Land Trusts can include real estate property, Mortgages, and Property Notes, unlike a Living Trust which can include far more. By establishing a Land Trust, you can assign a beneficiary that will continue to manage that asset at your passing, and the beneficiary may be different from the Living Trust Beneficiaries based on your individual needs.

Experienced Land Trust Planning and Creation You Can Trust

Anderson Advisors, under the leadership of real estate investors and real estate law expert Clint Coons, has set a precedent for the use of land trusts to provide privacy and protection for real estate investors. Anderson further perfected this approach by using land trusts in conjunction with LLCs to provide unparalleled asset protection for real estate investors, both large and small.

Get Your Land Trust Today

Fill out the form for a free Strategy Session with one of our Advisors.THE ANDERSON ADVANTAGE

Preserve

Individualized tax planning to help you keep as much of your money in your pocket as possible.

Protect

Asset protection strategies and solutions to shield your assets and limit personal liability.

Prosper

Retirement and financial planning and wealth management strategies to maximize what you already have.

What You Can Expect When Forming a Land Trust With Anderson

A land trust is similar to a living trust, but specially drafted to achieve the desired results. There is still a grantor, trustee, and a beneficiary, and these positions still have the same general roles and meaning. Once you and your advisor have determined who will fill each role, your land trust is drafted and sent to you for execution.

Your completed trust will contain all of the appropriate and required legal documents, including the assignment paperwork from your land trust to your LLC, providing the asset protection. In most states, we can also deed the property into your land trust for you.

While it seems like there are just a few simple steps to take, land trusts deal with sensitive information and processes. It is important that an attorney forms your trust, and you execute it to ensure you receive all the benefits and privacy from this tool. Schedule an appointment with an advisor today to discuss whether this is the best option for you.

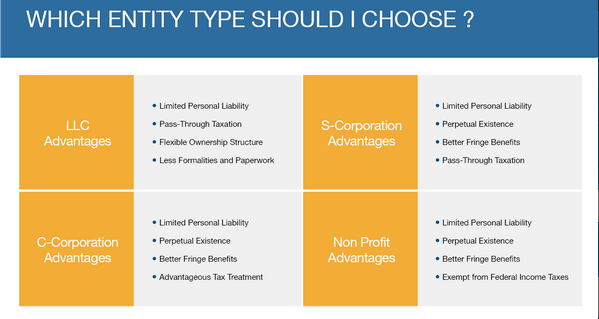

Your Custom Entity Blueprint

Speak with an Anderson Professional Advisor to get your business planning blueprint to determine the best entity structure plan for you and your unique situation.

Anderson Advisors FAQ

What is a Land Trust ?

A land trust is a real property title-holding vehicle, a trust agreement under which the beneficiary directs the trustee in all matters affecting title to the trust property. The beneficiary also holds the trustee free from liability. The trustee usually prepares the deeds and assignments of beneficial interests, whereas the managing beneficiary usually prepares the leases, loan documents and instruments, and other papers for trustee review and signature. In all cases, the beneficiary remains liable for trust property operations.

How did Land Trusts come about?

Land trusts have been around at least since Roman times, but their clearest history is from the time of King Henry VIII in England. At that time, people used land trusts to hide their ownership of land so they would not have to serve in the military or fulfill other obligations of land ownership. For example, an elder uncle would hold his nephew’s land so he would not have to join the king’s army. To end this, King Henry in 1536 passed the Statute of Uses. The statute declared that if one party held land “for the use of” or in trust for another (“beneficiary”), then legal title was vested in the beneficiary. Obviously, if the statute had been given literal effect, there would be no trust law. Shortly after the statute was enacted, however, English courts declared that the statute only applied if the trust was passive, that is, the trustee didn’t do anything but hold the land

What are the benefits of the Land Trust?

Uses and Benefits of the Land Trust

The uses and benefits of the land trust are varied. With a land trust, an individual or individuals can

- Have privacy of ownership and nonresident ownership.

- Avoid probate.

- Limit exposure to judgments and liens

- Avoid marital interest in title.

- Insulate from the hazards of individual ownership.

- Transfer beneficial interest.

- Use beneficial interests as collateral.

- Prevent separation of the land.

- Protect in the acquisition, development, and operation of apartment developments, condominium apartments, or cooperatives.

- Facilitate estate planning.

- Provide partnership, corporation, and agricultural land-use protection.

Learning Pages

Need More Help?

Contact Us For Additional Services.

Monday-Friday 8am-5pm PT