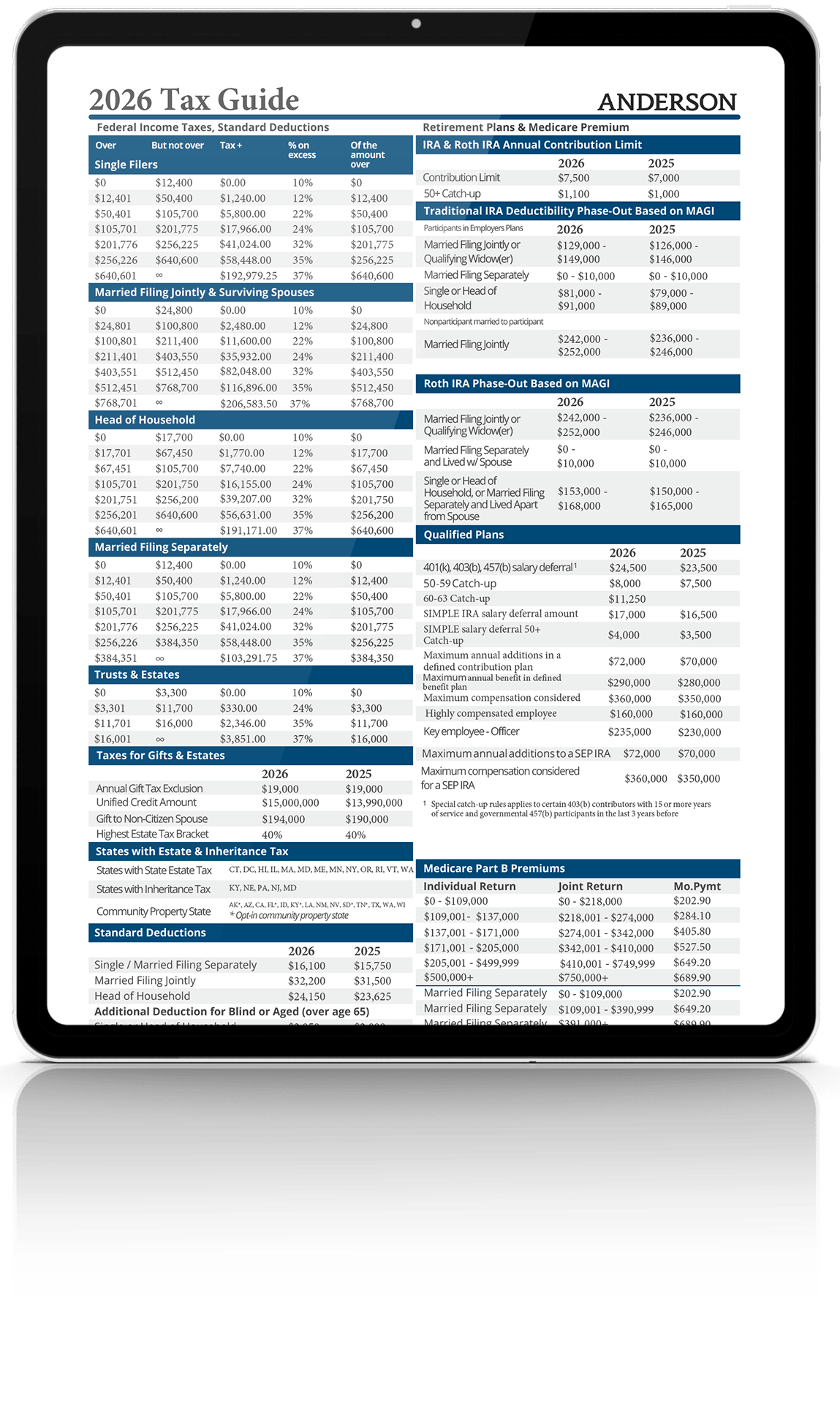

TAXGUIDE

Know Your Numbers Before You File

Most people don’t overpay in taxes because they’re careless.

They overpay because they don’t know the numbers until it’s too late to change the outcome.

The 2026 Tax Reference Guide puts the most important IRS thresholds in one place—so you can make informed decisions before income is earned, assets are sold, or deadlines pass.

Use it to:

Project your taxable income after deductions—not just gross earnings

Understand how tax brackets really work, so you can plan ahead of time

Plan capital gains strategically before selling real estate or investments

Optimize retirement and HSA contributions using the latest IRS limits

This framework helps investors avoid surprises and uncover opportunities others may miss.

Get Your Simple Reference for 2026 Tax Planning

Download Now!

FEATURED IN

ANDERSONADVISORS

What Anderson Can Do For You

At Anderson Advisors, we know investing comes with its own set of legal, tax, and compliance challenges—especially as you acquire more properties.

We treat every client as unique, with their own circumstances, goals, and market realities. Our lawyers, CPAs, and strategists work together to craft solutions that protect your profits, keep you compliant, and shield your personal assets from legal exposure.

Our nationally recognized principals, Clint Coons, Toby Mathis, and Michael Bowman, have decades of success advising and representing real estate investors on their tax and asset protection needs.

Our Specialties

Entity Formation

Wills & Trusts

Asset Protection Planning

Retirement Planning

Tax Planning

Business Compliance